Do the obligations of real estate owners to pay annual property taxes to the authorities mean that they do not own the property at all? No, that's not true: property ownership comes with rights and obligations, as defined by law. Owners have the right to own, dispose of, or bequeath properties, as is also guaranteed by the EU's Charter of Fundamental Rights. However, there are also obligations, also given by law, such as paying annual taxes, which municipalities use to finance services for residents.

The claim appeared in a video (archived here) published on TikTok on May 1, 2025. The person in the video says:

It is interesting that we still believe that something is ours. We buy land, property. It is great, finally I own something, something that is mine. But then the reality checks in, you do not really own something. If you do not pay tax they will take it from you. And if they can take it from you, then it means you do not really own it at all...So why do we pay that? Because we want to survive and keep the property, even though it does not belong to you...

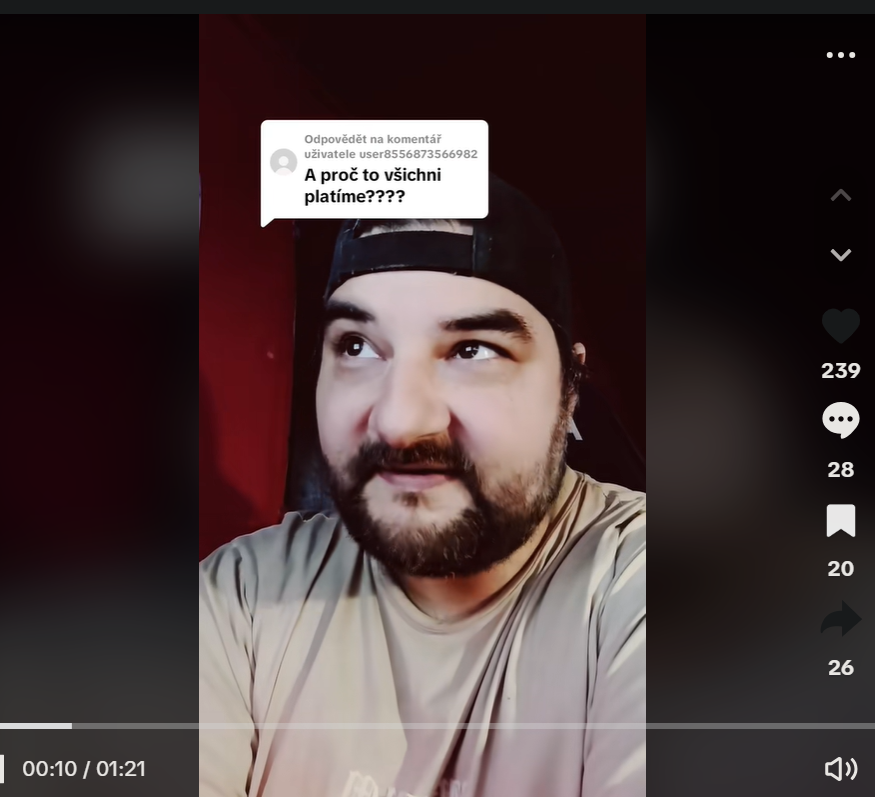

This is what the post looked like on TikTok at the time of writing:

(Source: TikTok screenshot taken on Fri May 9 07:51:17 2025 UTC)

The statement made in the video above is misleading. The fact that one has to pay a recurring annual property tax (archived here) as one of the obligations imposed by law (archived here) does not mean that the asset belongs to the state rather than the owner. The tax payment is one of the obligations linked to real estate ownership, but it does not interfere with the owner's right to private property.

The annual property tax in the Czech Republic is primarily used by municipalities and local governments to finance public services and local infrastructure. The revenue from this tax supports (archived here) essential community services such as firefighting, public schools, pavement maintenance, public parks, and street upkeep. This funding helps municipalities provide these services free of direct charge to residents. Like other taxes, there are penalties and interest on late payments if someone fails to meet the deadline.

The ownership rights, classified as rights in rem (archived here), are regulated by the Czech Civil Code (archived here). Specifically, in the case of real estate, ownership is acquired by entry (archived here) into the relevant Land Registry (archived here), which is administered by the Czech state through specialized cadastral offices. This registry is legally determinative, meaning ownership rights, including mortgages, easements, and other in rem rights, originate, change, and cease upon their registration there, except in cases such as proven fraud.

The Czech Civil Code, effective since 2014, governs real estate ownership comprehensively (archived here), including conveyance contracts and related rights. Ownership enjoys constitutional protection, and expropriation is only permitted under strict legal conditions for public interest and with fair compensation.

The European Union also protects property ownership rights under its Charter of Fundamental Rights (archived here). Article 17 states everyone can own, use, dispose of, and pass on their lawfully acquired possessions. Deprivation of possessions is only allowed in the public interest, under conditions provided by law, and subject to fair and timely compensation.

The post is also linked to the fact that the Czech Republic increased (archived here) its annual property tax rates by approximately 80 percent starting in 2024, marking a significant rise from previous levels. The levy still remains one of the lowest (archived here) among the EU countries.