Did the Czech State Pension Insurance System end with a surplus, meaning it collected more money from workers in pension insurance premiums than it paid out in pensions to retirees? No, that's not true: in 2022, the state pension system revenues were lower than its expenditures, according to official data.

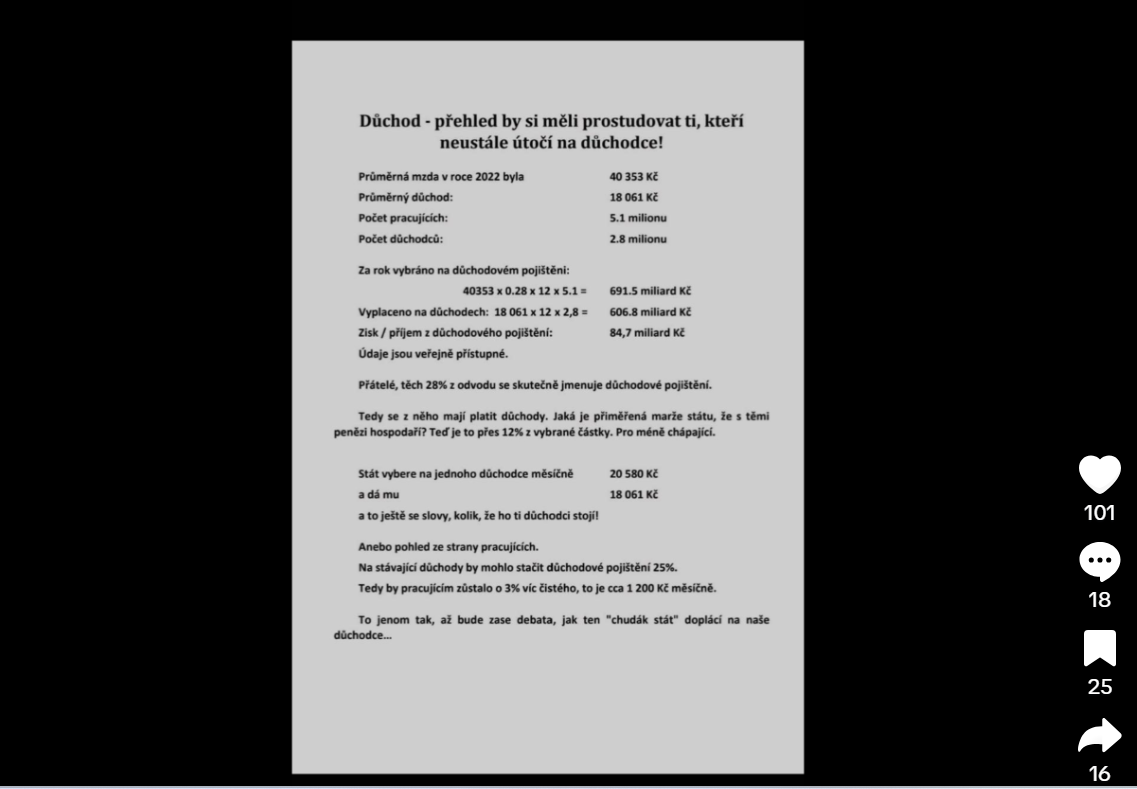

The claim appeared in a video (archived here) which was published on TikTok on November 22, 2023. It contains a calculation of revenues and expenses of the pension system in 2022, concluding that the state collected more from workers in the pension premium insurance than it paid out to retirees. It also contains a text:

Those who constantly attack pensioners should take a look at this

Just in case there is another debate about how the state pays extra to pensioners

This is what the video looked like at the time of writing:

(Source: TikTok screenshot taken on Wed Dec 16 06:06:00 2023 UTC)

While some of the data used in the text, such as the 2022 average wages and average pensions, is accurate, the calculation itself is flawed. It fails to consider that self-employed individuals often contribute less to the system than employees and that a significant portion of the population earns less than the average wage. The video claims that the state had a surplus of 84.7 billion koruna in the pension system for 2022, contrary to official data which indicates a deficit for the same period. According to Finance Ministry records, the state collected 573.2 billion koruna in 2022, while expenditures, primarily pensions, totaled 594.7 billion koruna, resulting in a deficit of 21.5 billion koruna.

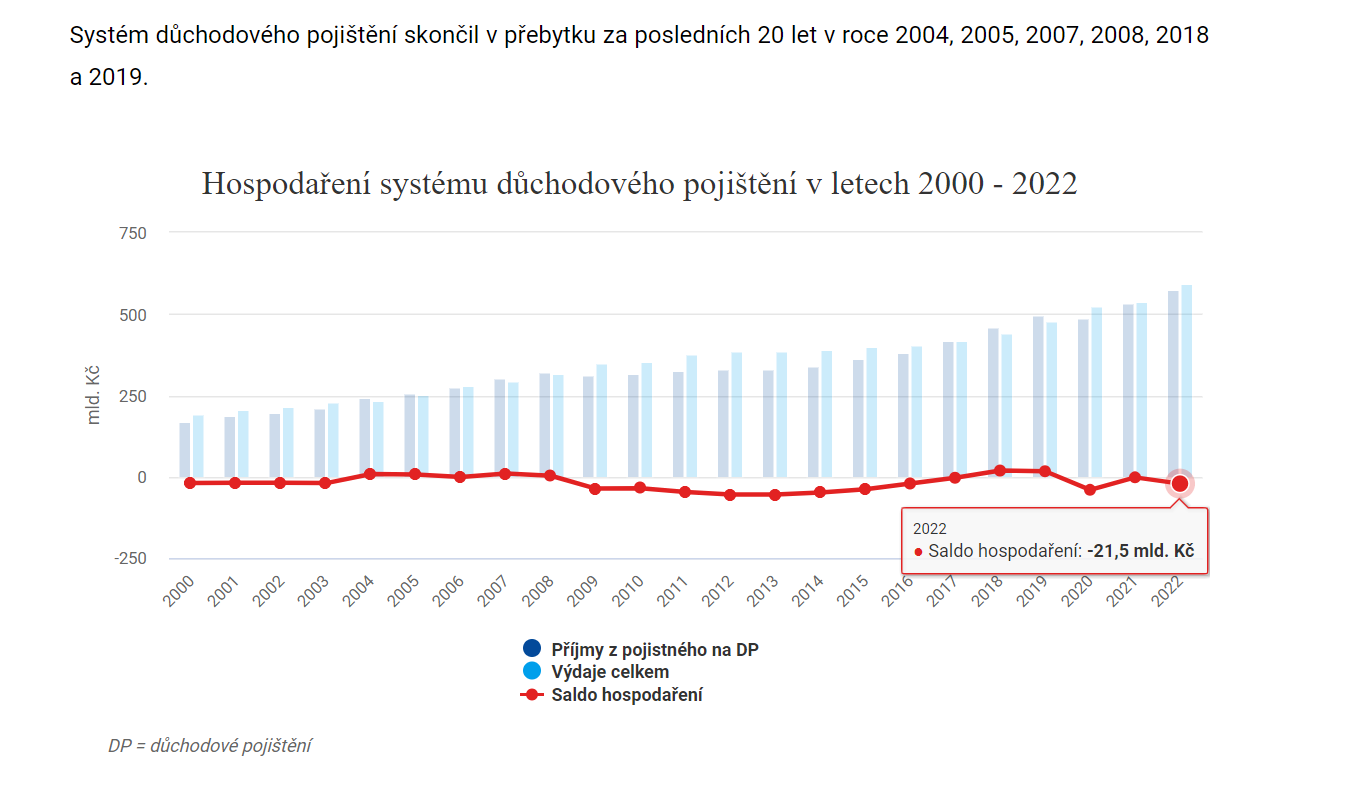

(Source: The Czech Finance Ministry, screenshot taken on Wed Dec 16 06:18:00 2023 UTC)

The methodology for calculating the revenues and costs of the pension system is outlined in a decree established in 2005.

In the event of a shortfall in the pension system, the state is obligated to tap into alternative funding streams from its budget to meet the increased pension expenses. On the other hand, when the system is in equilibrium or experiences a surplus, it indicates that the funds garnered by the state through pension insurance premiums from employers, employees, and the self-employed are sufficient to cover the entirety of pension outlays, including the expenses associated with pension administration.

The Czech Finance Ministry reports that the pension scheme registered a surplus only in the years 2004, 2005, 2007, 2008, 2018, and 2019 over the past two decades.

According to the economists, the current Czech pension system is unsustainable and needs to be reformed as demographic changes in population are expected to put even more pressure on its financing. In November 2023, the government disclosed its proposed changes, which involved delayed retirement and more modest increases in pension amounts.